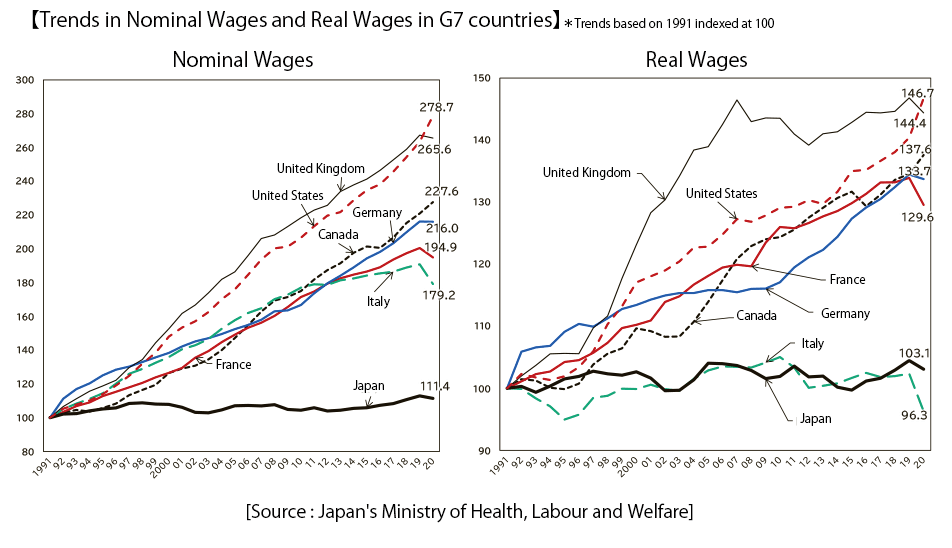

If you are a worker with a strong interest in salaries or raises, you may have seen the following graph at one time or another.

This graph shows the wage trends of major advanced countries (Japan, the United States, the United Kingdom, Germany, France, Italy, and Canada) over a 30-year period from 1991 to 2020. As can be seen at a glance, wages have significantly increased in all countries except Japan, where nominal and real wages[*] have remained almost unchanged over the 30 years.

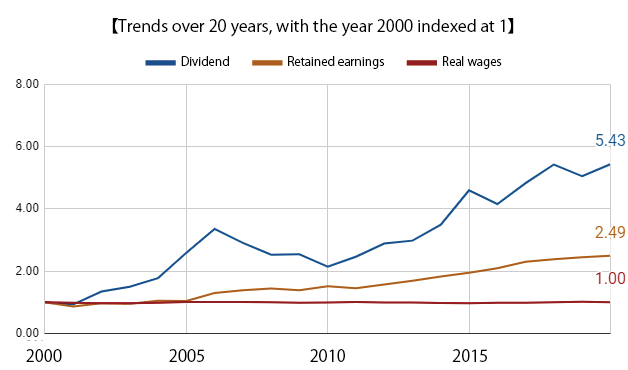

Looking at this graph, one might think that Japan is in an “overall” recession. However, looking at the 20-year period from 2000 to 2020, for example, the dividends paid by Japanese companies to shareholders have increased more than five-fold. The next question that comes to mind is, “Aren’t companies getting poorer by paying too much money to shareholders? However, retained earnings, meaning corporate savings, have more than doubled from 2000 to 2020.

What these data show is not that Japan is “overall” in a recession, but rather that while both shareholders and companies are becoming “rich” in Japan, only the real wages of workers are not increasing.

No comments yet.